February 05, 2026

By Adjoa Kyerematen

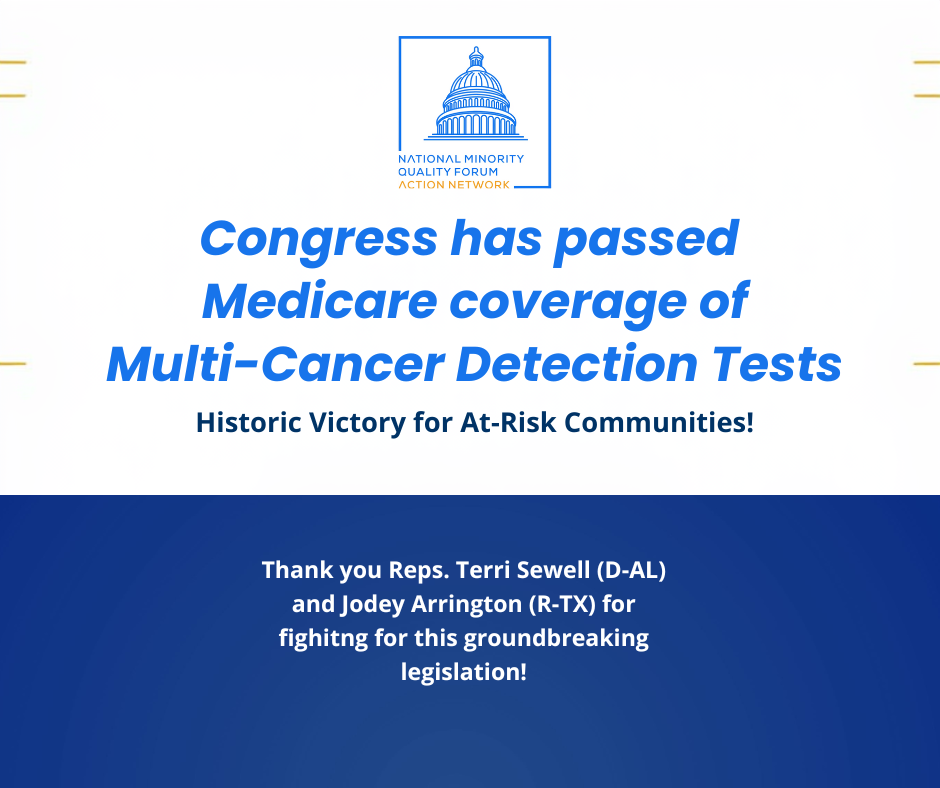

NMQF Statement Applauding Passage of Landmark Legislation to Advance Presymptomatic Cancer Detection

Read More

Posted December 18, 2013 | Updated February 17, 2014

By Gary A. Puckrein

Published On The Huffington Post

If I mentioned “specialty tier” to you, would you have any idea what I was talking about? Specialty tiers are seldom considered in everyday conversation, but if you become ill, you may learn that a specialty tier is essential to your survival.

In most developed countries, medical care (including drugs, devices, and professional services) is purchased primarily through insurance (through a private insurer, through government-mandated social insurance, or through social welfare), because the average consumer does not have the financial capacity to purchase health care directly in the marketplace. Group health-insurance plans have evolved in response to this incapacity. The principal feature and benefit of group insurance (private or public) is the pooling and sharing of beneficiary risk. This feature allows the members — the consumers — to purchase essential and efficacious medical therapies whose costs might otherwise be prohibitive.

Unfortunately, over the past thirty years, insurers and payers have tended to reflect less risk in the premium and shift the costs of health care to the insured at the moment of care in the forms of copayments, deductibles, and coverage limitations. This trend has undermined the primary benefit of health insurance to many beneficiaries: sharing of collective risk to afford what would otherwise be unaffordable.

Enjoy This Post? Read More Articles Below