February 05, 2026

By Adjoa Kyerematen

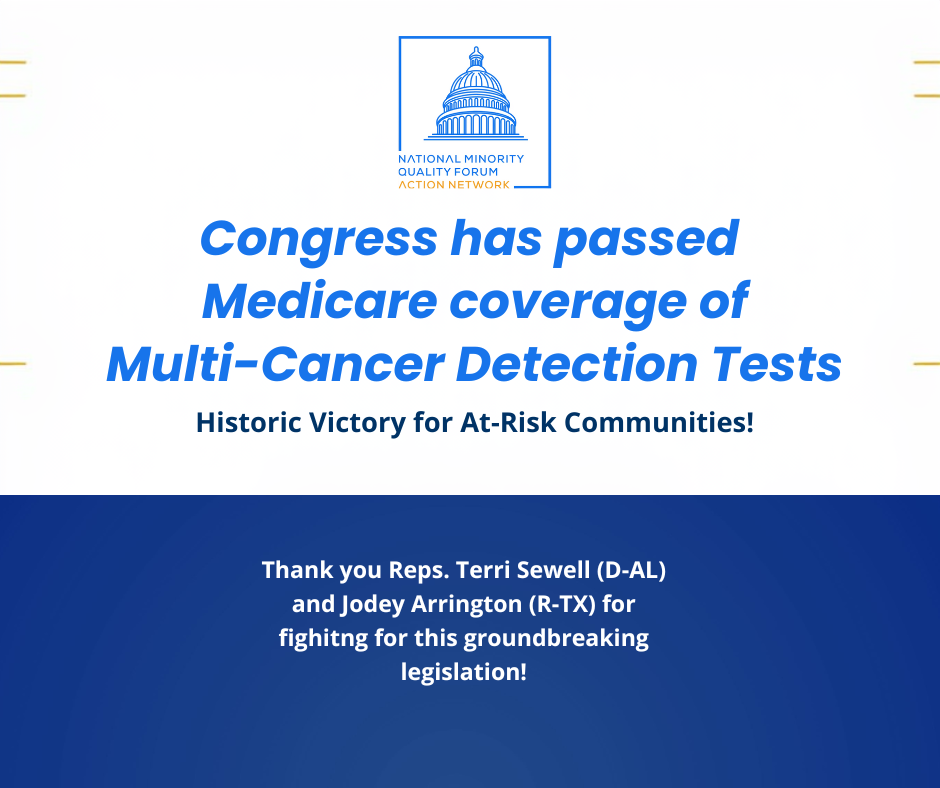

NMQF Statement Applauding Passage of Landmark Legislation to Advance Presymptomatic Cancer Detection

Read More

10 December 2019

By Gary A. Puckrein, PhD

As Congress edges closer to finding a resolution to ‘Surprise Medical Billing,’ it is important to remember how patients are the ones affected most by the unanticipated financial exposure that these bills can bring and which can have catastrophic consequences for families and communities, especially those living in rural and inner-city communities.

The National Quality Forum (NMQF) supports a comprehensive, solution to end the structural practice of surprise billing that bolsters transparency in our healthcare system, averts government interference or price setting, and holds patients harmless from the vagaries of insurer and provider payment mechanisms.

Hospitals that serve the most vulnerable patients would face significant challenges in making up for the revenue lost in a solution that drives down reimbursement rates to unsustainable levels. According to information from America’s Essential Hospitals, in 2017, their members had average uncompensated care costs of $68,045,760; yet the nationwide average for uncompensated care costs for all US hospitals was $7,297,605. The challenge is clear – hospitals that bear a significant burden of uncompensated care cannot afford a bad policy, and neither can the patients they serve.

NMQF supports solutions to the surprise billing conundrum that incorporate Independent Dispute Resolution (IDR).

IDR is a process for resolving reimbursement disputes between providers and insurance companies when an agreement cannot be otherwise reached for care already provided to a patient. Patients only have to cover their usual in-network co-pay for emergency or certain other instances of out-of-network care while payment disputes are resolved between the physician and the insurance company. IDR enables both providers and insurers to resolving these disputes by submitting information on the care provided to an independent third-party along with “final offers” on payment from both sides.

This simple process, which has minimal costs, resolves the challenge of determining a “fair” price for services already provided, and where negotiations over a price have reached an impasse. This gives providers and insurers a choice – they can either work to reach a mutually agreeable payment rate or the IDR process will determine which side is being most reasonable. In essence, IDR forces providers and payers to work together.

According to the Commonwealth Fund, 27 states have implemented surprise billing laws of various scopes. Recognizing that IDR can protect consumers while ensuring a fair process for all stakeholders, 11 states have IDR processes in place – including 7 of the 13 states with comprehensive surprise billing solutions. A case study on New York’s law found that it had the intended effect – it pushed providers and insurers to be reasonable. This is a win for patients and a better health care system.

Only a strong IDR process ensures that patients are protected and the health care system is improved. As Congress considers ways to enact thoughtful, legislation to address this issue, legislators should ensure all providers and insurers have access to this dispute resolution process. Provisions being considered that would place barriers to accessing the process, such as cost thresholds for when this process can be accessed, will distort the market for services below the threshold and undermine the goal of improving the health care system.

The National Minority Quality Forum encourages Congress to act now and enact legislation that makes insurance companies and providers accountable and holds patients harmless.

Enjoy This Post? Read More Articles Below