November 13, 2025

By Adjoa Kyerematen

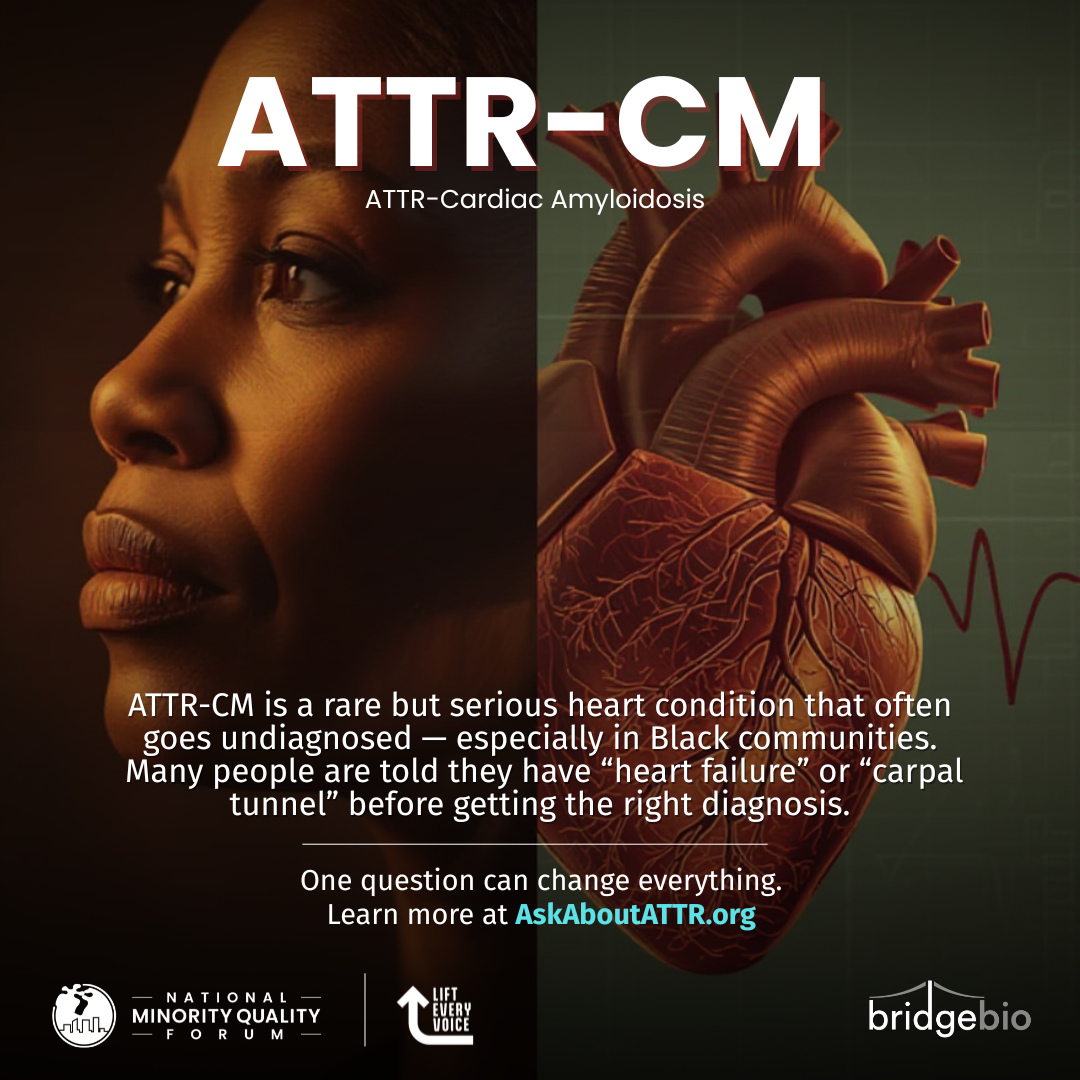

National Minority Quality Forum Launches AskAboutATTR.org to Empower Communities with Knowledge on Rare Heart Condition

Read More

Posted February 16, 2012 | Updated April 17, 2012

By Gary A. Puckrein

Published on the Huffington Post

I hate to say “I told you so” but, as we discussed in my Jan. 31 post, (The Case Against Individual Retail Transactions), with the democratization of health care we can expect moments when we will hear cries of outrage as government in its less-than-delicate way steps on the toes of a few as it seeks to serve the many. It is unfortunate, but it is also necessary and unavoidable.

An immediate case in point is the controversy surrounding the Obama administration’s decision to require religious employers to include in their health benefit packages contraceptive services for women. The episode offers a teachable moment.

Employee health benefits are actually wages that are not paid directly to the worker (by worker I mean the 1% as well as the 99%); the dollars are withheld and transferred to an insurer. Government decided in the 1940s not to tax health benefit as income (though from time to time the thought does cross its mind), but they are still wages paid in fulfillment of a work contract.

Some would suggest that both employer and employee make a contribution to health insurance and they view the employer contribution as the employer’s money. Rubbish. There has been a practice of lowering compensation to workers by shifting a greater percentage of the insurance burden to them by getting employees to use some of their direct wages as a “copayment” for health benefits. It might appear as if magnanimous employers are providing uncompensated dollars to buy health care for their workers, but that is a shell game. The employer contributions, the term “copayment” notwithstanding, are wages taxable as such when government gets around to it.